M&A Insights

Stay on Top of the Changing M&A Landscape.

From Valuation to Closing: How M&A Advisors Manage Confidential Sales

When Suitors Come Knocking {with a diligence phalanx in tow}

The dynamic of running an M&A sale process differs significantly from responding to unsolicited offers. Using an Indication of Interest (IOI) can streamline initial evaluations, preserving sensitive information and saving time. If interest persists, running a competitive process can maximize value. Ultimately, understanding who is courting whom is crucial for navigating these transactions effectively.

Understanding Indemnification Terms in M&A Transactions: Key Considerations for Buyers and Sellers

{M&A Process/12}Negotiation, signing, and closing

Essential Questions for Buyers and Sellers in Initial M&A Discussions

What questions should you or your advisor anticipate from buyers during an initial call or meeting? And, if you're a buyer, what questions should you ask?

{M&A Process/11} Letters of Intent(LOIs)

Maximizing Synergies in M&A: How Strategic Buyers Drive Higher Valuations

Most M&A participants know that strategics - whether a corporate buyer or a PE portfolio company (a hybrid strategic) - tend to value targets the most because of synergies. So, what goes into synergies and, more importantly, using them to drive purchase price?

{M&A Process/10} Indicative offers and management meetings

Exclusivity Agreements: When and How to Use Them

Kicking off another post, this time focusing on exclusivity or no-shop provisions.

{M&A Process/9} Going to market

Navigating 'Simple' Deals: Avoiding Pitfalls in Buy-Side Transactions

{M&A Process/8} Buyer list

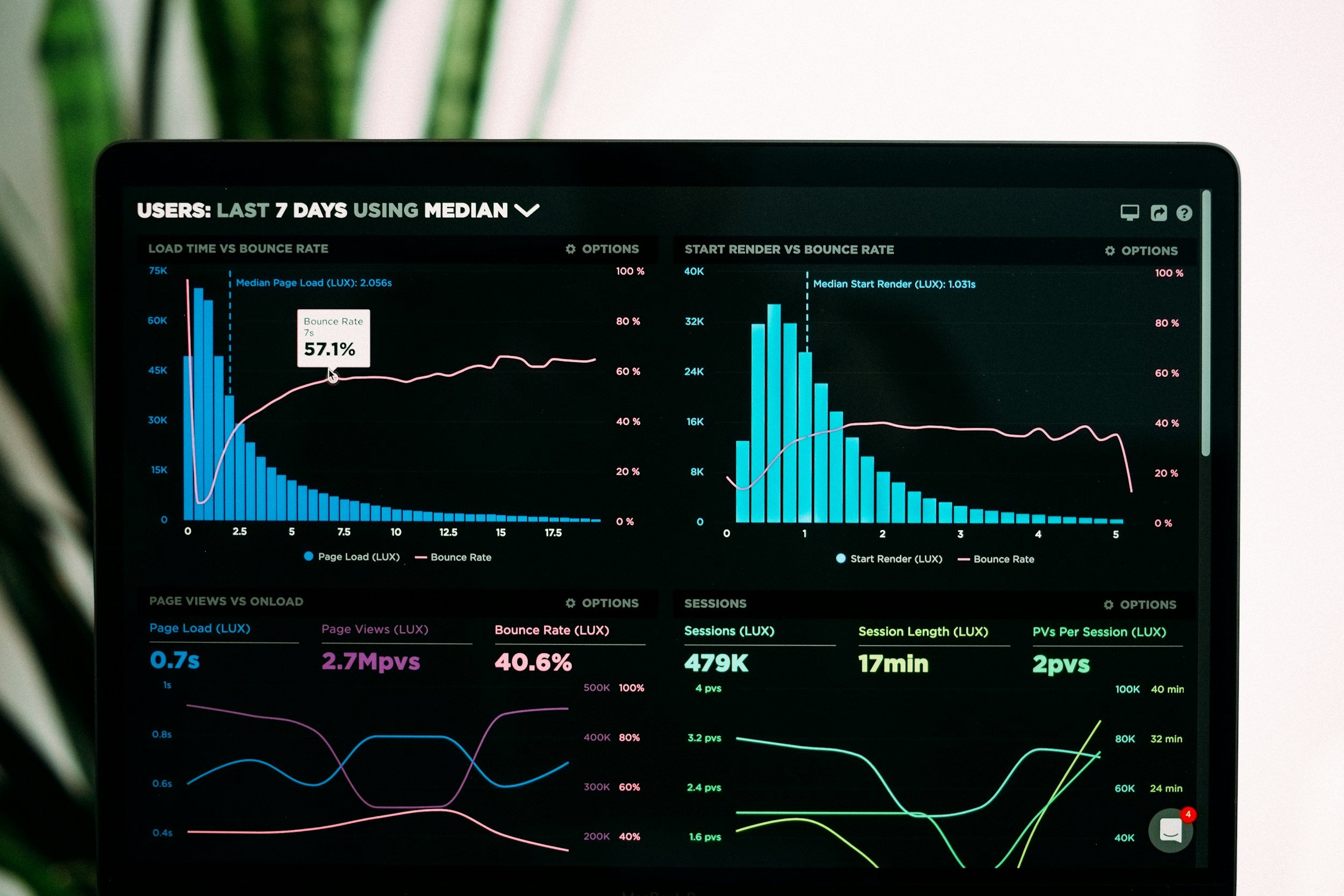

M&A Deal Points | A Deep Dive on SaaS Valuation

We now turn to a final factor that quantifies elements from across the other factors: SaaS metrics.

{M&A Process/7} Prearranged financing

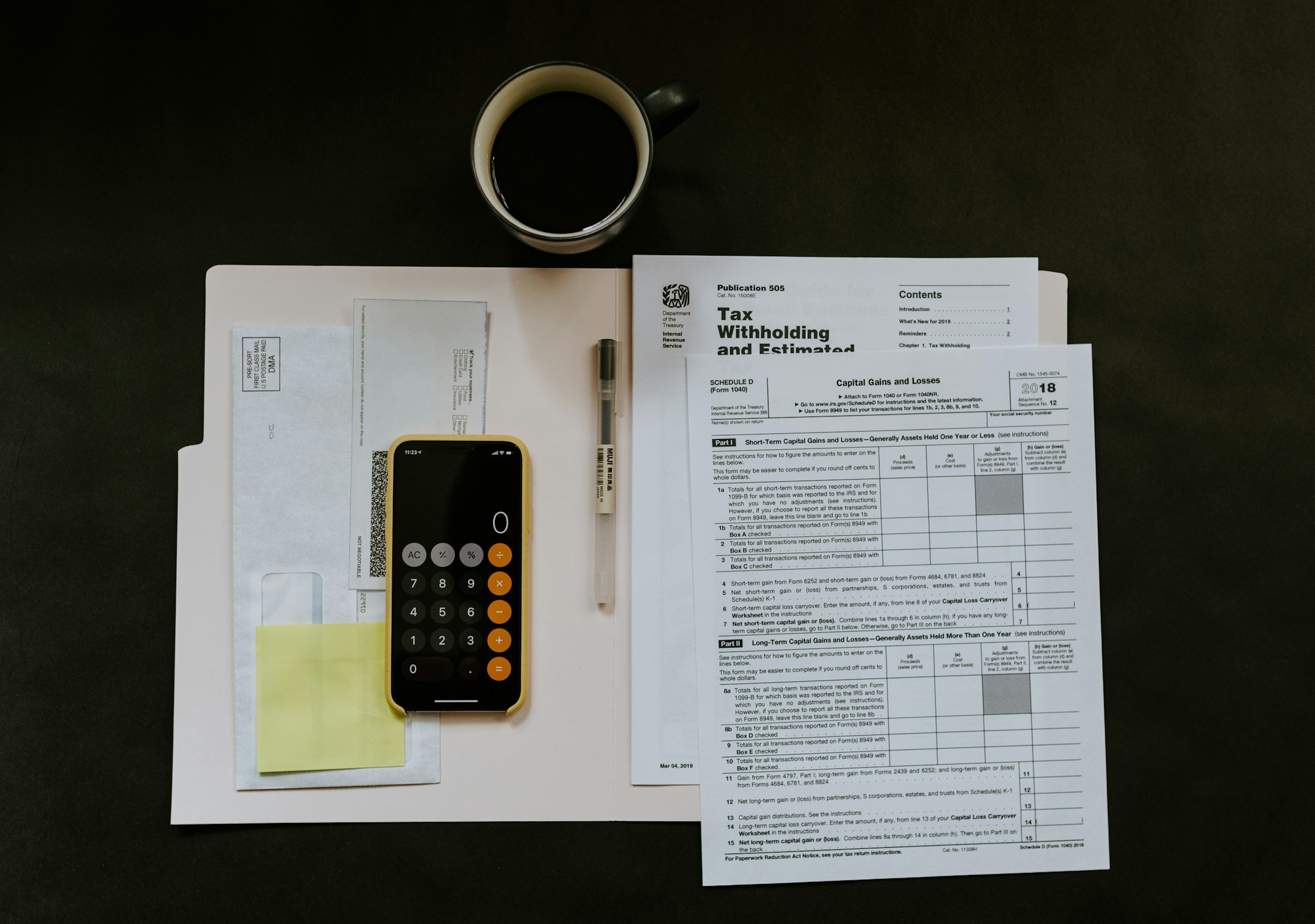

Deciphering Deal Structures: Insights into M&A Consideration Mix

In M&A, the consideration mix or deal structure can be just as crucial, if not more so, than the headline purchase price for sellers. Earnouts, rollover equity, and seller notes don't always translate into expected cash returns.

{M&A Process/6} Marketing materials

One of the things we often highlight at Sierra Pacific Partners is the importance of a cohesive deal team with open lines of communication. What could be wrong with that?

Maximizing Business Value: Insights from M&A Advisors

In M&A, sellers often hold optimistic views on their business's value. Our role as advisors is to provide data-driven valuation advice. During a discussion on diligence with a client, we emphasized the need for focus and momentum in the sale process.

{M&A Process/5} Market Intelligence

Once engaged, Sierra Pacific Partners conducts a market study using proprietary databases to assess the company’s value, determine active buyers in the industry, and talk to those buyers to uncover how they view and weigh various value drivers

Deal Diary: How to Handle Minority and Marketability Discounts in Operating Agreements

Recently, while drafting an operating agreement for a surgery center, we used a formula-based redemption price with an appraisal option if contested. Should appraisers apply minority and marketability discounts?

{M&A Process/4} Sell-side Preparation

Both prior to and following engagement, we’ll need information from the seller to assist with valuation, marketing, and diligence.