M&A Insights

Stay on Top of the Changing M&A Landscape.

Financing Transactions

Why Asset Deals Dominate Smaller M&A Transactions

Navigating the Biggest Challenges in M&A Transactions

Mergers and acquisitions (M&A) can be complex and fraught with potential pitfalls. Several common factors can derail a deal, leading to frustration and wasted resources for all parties involved. From time-related issues like deal fatigue to financial discrepancies, due diligence surprises, and employee retention concerns, these deal killers can arise at any stage of the process.

What is Representation and Warranty Insurance?

What is a Quality of Earnings Report?

What is EBITDA and Why is it Used in M&A Valuation?

What is Adjusted EBITDA and an Add-back?

What Does “Cash-free, Debt-free” Mean in M&A Transactions?

What is Working Capital and How Does it Work in M&A Transactions?

The Role of Default Positions in M&A

Default positions in M&A terms, which occur automatically unless changed, significantly impact deals. They also determine where earnout funds are held and whether post-closing roles renew automatically. These defaults influence transactions both legally and through relationship dynamics.

How to Choose the Right Bidder in a Sell-Side M&A: Evaluating LOIs

It all begins with an idea.

From Valuation to Closing: How M&A Advisors Manage Confidential Sales

Understanding Indemnification Terms in M&A Transactions: Key Considerations for Buyers and Sellers

Exclusivity Agreements: When and How to Use Them

Kicking off another post, this time focusing on exclusivity or no-shop provisions.

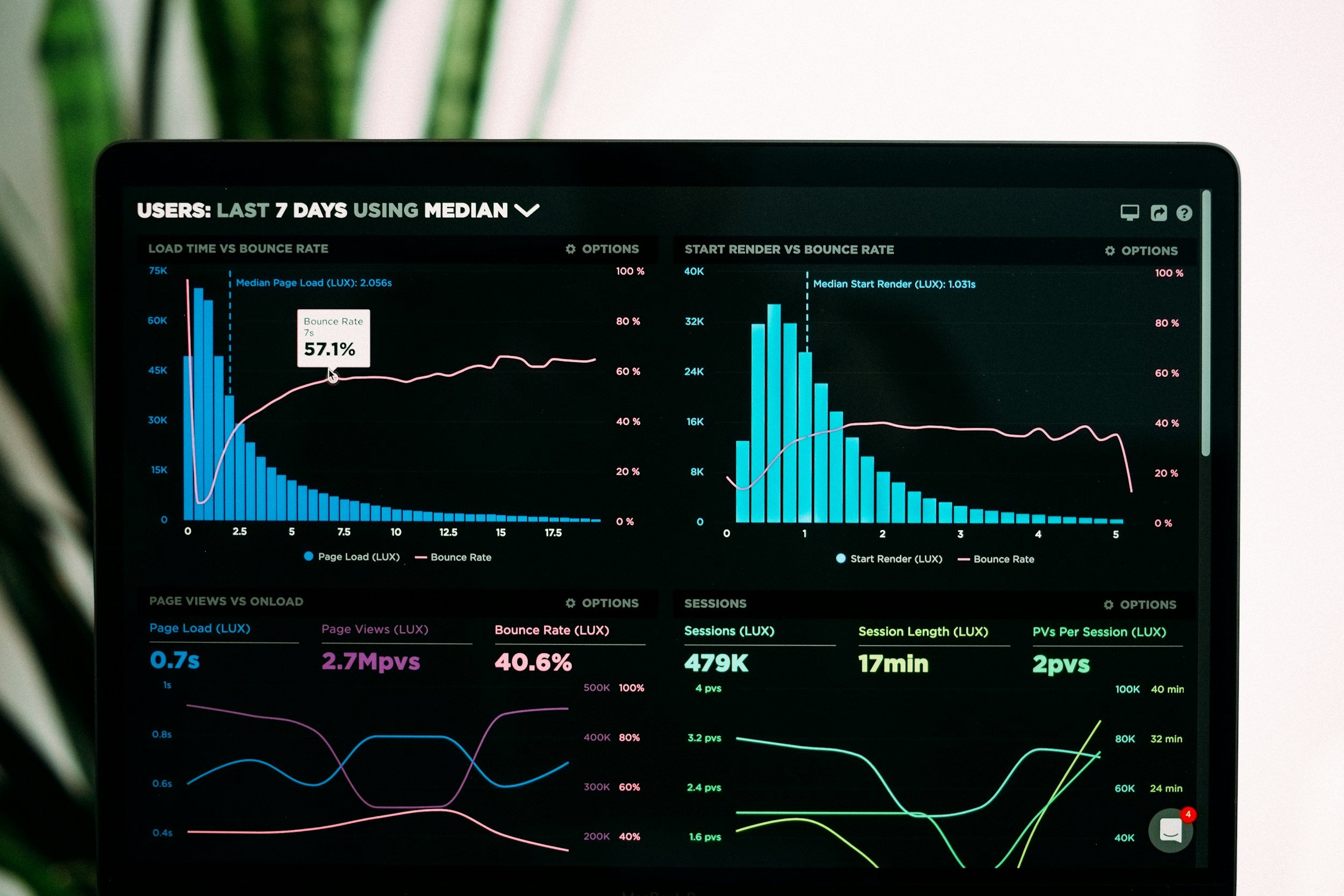

M&A Deal Points | A Deep Dive on SaaS Valuation

We now turn to a final factor that quantifies elements from across the other factors: SaaS metrics.

Deciphering Deal Structures: Insights into M&A Consideration Mix

In M&A, the consideration mix or deal structure can be just as crucial, if not more so, than the headline purchase price for sellers. Earnouts, rollover equity, and seller notes don't always translate into expected cash returns.

Deal Diary: How to Handle Minority and Marketability Discounts in Operating Agreements

Recently, while drafting an operating agreement for a surgery center, we used a formula-based redemption price with an appraisal option if contested. Should appraisers apply minority and marketability discounts?

SaaS Valuation Demystified: Tips for Buyers and Sellers in the Market

Traditional SBA valuation metrics often fall short when applied to SaaS businesses due to their unique characteristics, such as huge total addressable markets and opportunities for explosive growth. This has created a market where business transfers command higher prices, attracting various buyers with ample funding sources.

Unlocking M&A Value: Harnessing Synergies to Drive Purchase Price

Strategic buyers in M&A transactions often value targets higher due to potential synergies. Unlike non-strategics who base valuations on EBITDA, strategics consider added value from synergies, such as cost savings, revenue enhancement, gross margin improvement, and strategic benefits.