M&A Insights

Stay on Top of the Changing M&A Landscape.

What Are Some Unique Considerations for Selling a Distribution Business?

Understanding Valuation Multiples: Why Your Business is Unique and What Factors Influence the Range

What Do I Need to Keep in Mind if I’m Considering Selling to a Competitor?

From Valuation to Closing: How M&A Advisors Manage Confidential Sales

What Are Some Unique Considerations for Selling a Construction Business?

What Are Some Unique Considerations for Selling a HVAC Business?

{M&A Process/9} Going to market

Ready to Sell Your Business? Here’s How to Take the First Step

What does it take to capture a buyer's attention and prompt them to submit a Letter of Intent (LOI)? According to the latest Alliance of M&A Advisors survey, several key factors influence buyers' decisions, including growth potential, stable revenue, quality of the management team, EBITDA margin, and synergies.

What Are Some Unique Considerations for Selling a Manufacturing Business?

What Are Some Unique Considerations for Selling a Trucking and Logistics Business?

How are Lower Middle Market Companies Valued?

Understanding Indemnification Terms in M&A Transactions: Key Considerations for Buyers and Sellers

{M&A Process/3} Different types of M&A sale processes

There are a number of ways to transfer a company depending on client goals and circumstances y or combination.

Deal Diary: How to Handle Minority and Marketability Discounts in Operating Agreements

Recently, while drafting an operating agreement for a surgery center, we used a formula-based redemption price with an appraisal option if contested. Should appraisers apply minority and marketability discounts?

Deciphering Deal Structures: Insights into M&A Consideration Mix

In M&A, the consideration mix or deal structure can be just as crucial, if not more so, than the headline purchase price for sellers. Earnouts, rollover equity, and seller notes don't always translate into expected cash returns.

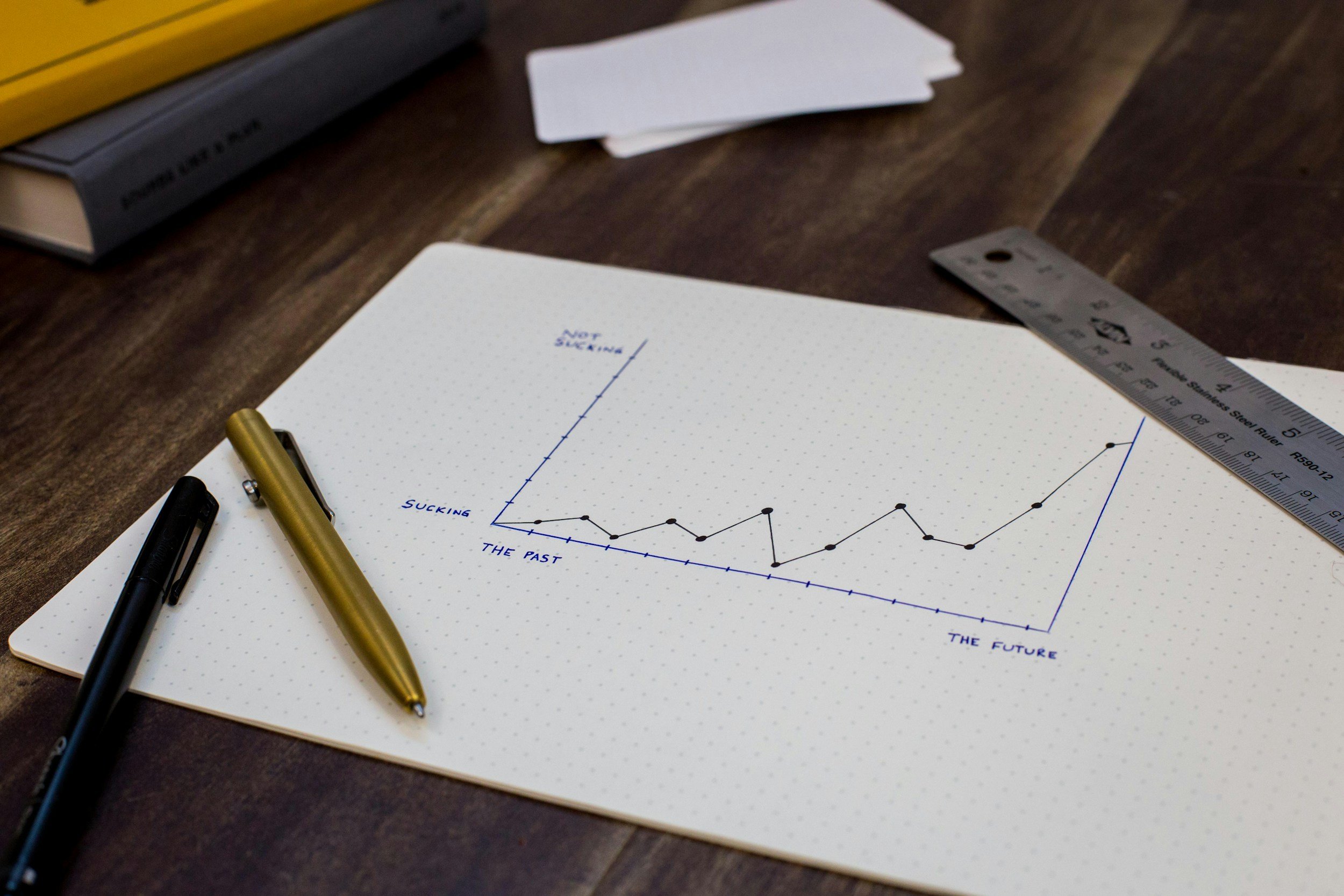

Maximizing Business Value: Insights from M&A Advisors

In M&A, sellers often hold optimistic views on their business's value. Our role as advisors is to provide data-driven valuation advice. During a discussion on diligence with a client, we emphasized the need for focus and momentum in the sale process.

SaaS Valuation Demystified: Tips for Buyers and Sellers in the Market

Traditional SBA valuation metrics often fall short when applied to SaaS businesses due to their unique characteristics, such as huge total addressable markets and opportunities for explosive growth. This has created a market where business transfers command higher prices, attracting various buyers with ample funding sources.