M&A Insights

Stay on Top of the Changing M&A Landscape.

Ready to Sell Your Business? Here’s How to Take the First Step

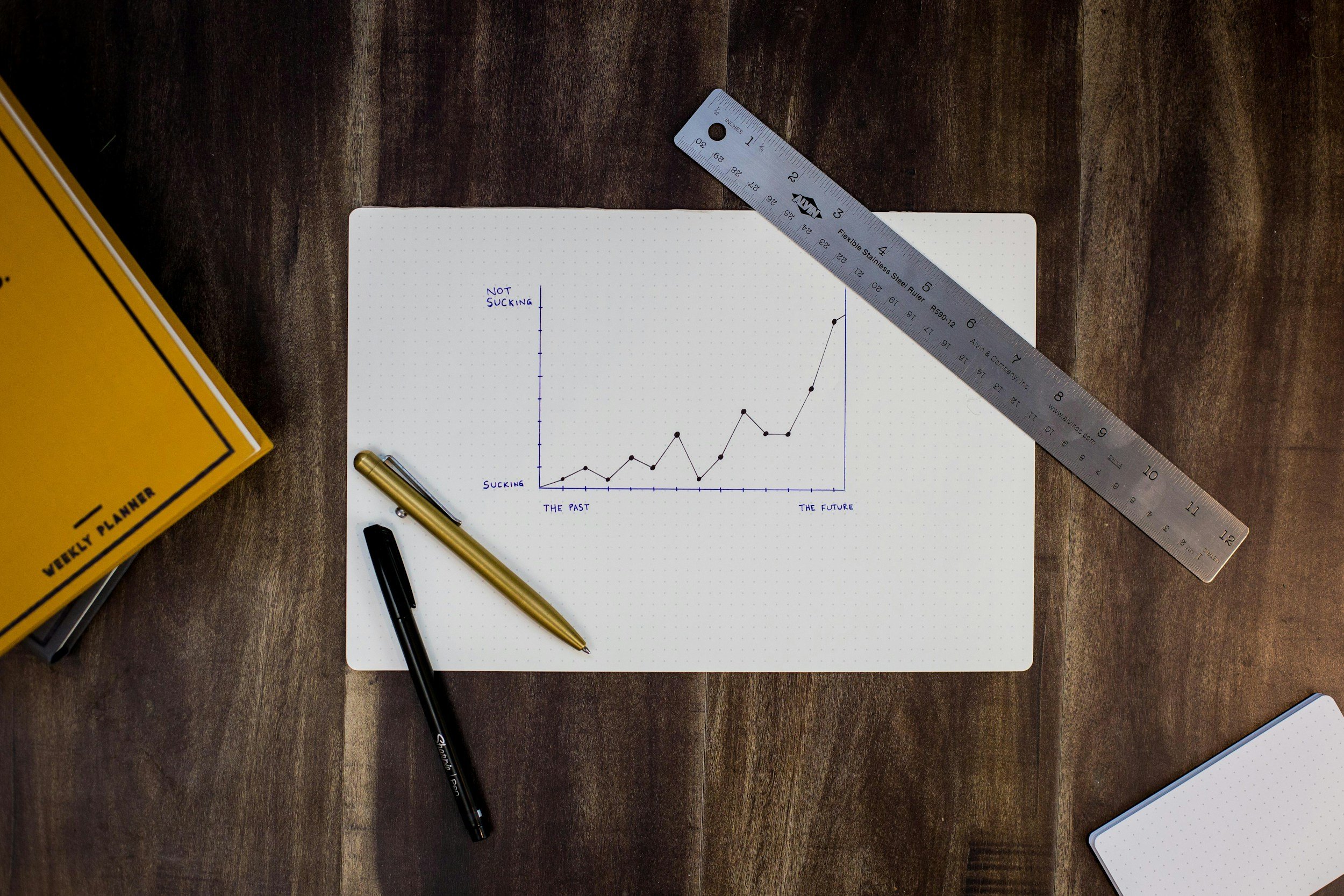

What does it take to capture a buyer's attention and prompt them to submit a Letter of Intent (LOI)? According to the latest Alliance of M&A Advisors survey, several key factors influence buyers' decisions, including growth potential, stable revenue, quality of the management team, EBITDA margin, and synergies.

Healthcare Cap Stack Heat Map | What’s Market in Early-Stage Medtech?

{M&A Process/7} Prearranged financing

Driving Value: Bridging GAAP Gaps in R&D Treatment

M&A Deal Points | Deal financing

What Are Some Unique Considerations for Selling a Manufacturing Business?

Bridging GAAPs: R&D Treatment and the True Value Story

Medical Education Financing Reform: Implications for the Future Healthcare Workforce

FDA Policy Shift: Implications for MedTech & Diagnostics

From step Counters to Clinical Tools: How Wearables Are Maturing into VBC Infrastructure

DealScape | AI in Medtech

Deal Diary: What Happens When a Buyer Pulls the Plug?

What could make a buyer walk away from the deal?

What is Representation and Warranty Insurance?

What is a Quality of Earnings Report?

What Are Some Unique Considerations for Selling a Trucking and Logistics Business?

Navigating the Biggest Challenges in M&A Transactions

Mergers and acquisitions (M&A) can be complex and fraught with potential pitfalls. Several common factors can derail a deal, leading to frustration and wasted resources for all parties involved. From time-related issues like deal fatigue to financial discrepancies, due diligence surprises, and employee retention concerns, these deal killers can arise at any stage of the process.

Market Signal | Epic’s Next Move in Patient-Facing AI

DealScape | Dermatology M&A: Core Drivers and Ancillaries

DealScape | Healthcare Services M&A: Stabilizing, but Still Strategic